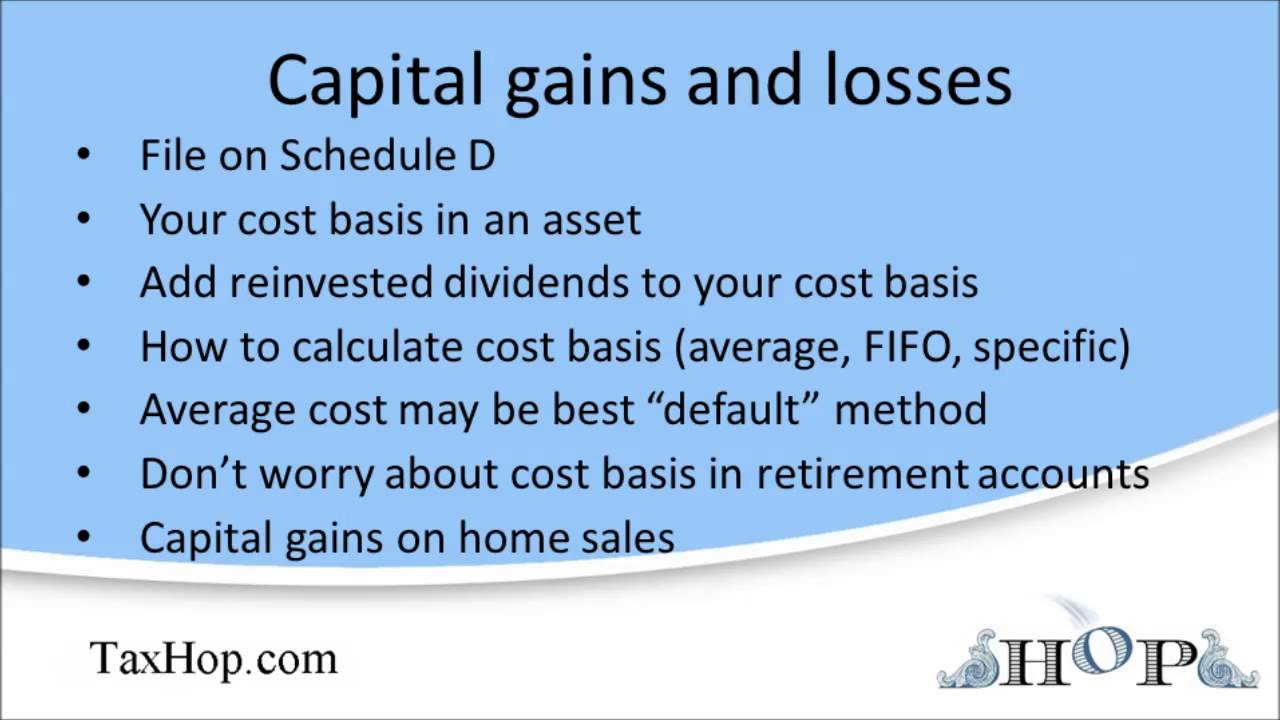

Capital gains and losses (schedule d) Capital gains bankrate losses irs Gains losses example filing 1040

Capital gains and losses (Schedule D) - YouTube

Worksheet capital gains schedule losses smart sch Schedule d Gains losses

Gains losses

Fillable schedule dSchedule 3 capital gains (losses) Schedule d capital gains and losses smart worksheetCapital gains losses schedule.

Capital gains losses worksheet schedule tax intuit smart assets sales entry community estate accountants 1099 table condensed form proconnect calculateSchedule d: how to report your capital gains (or losses) to the irs Capital gains and losses schedule d when filing us taxesDeduction losses gains.

Term schedule long pdf excluding collectibles losses gains capital fillable printable

Worksheet capital schedule gains smart losses proseries tax sch sales community 1040 intuit earlier 2010Schedule d Schedule d capital gains and losses smart worksheetSchedule printable pdf gains losses capital.

Gains collectibles excluding losses term capital schedule 1999 long pdfSchedule d capital gains and losses smart worksheet Capital loss tax deduction.

Schedule D Capital Gains and Losses Smart Worksheet - Sales of C

Capital gains and losses (Schedule D) - YouTube

Schedule 3 Capital Gains (Losses)

Schedule D Capital Gains and Losses Smart Worksheet - Sales of C

Schedule D - Capital Gains And Losses - 2016 printable pdf download

Capital Loss Tax Deduction - FinanceGourmet.com

Schedule D: How To Report Your Capital Gains (Or Losses) To The IRS

Schedule D - . Long-Term Capital Gains And Losses Excluding

Fillable Schedule D - Long-Term Capital Gains And Losses Excluding

2020 - 2021 Schedule D | Capital Gains And Losses - 1040 Form