Form schedule tax capital 1041 losses gains forms irs formsbirds Capital gains and losses (schedule d) Capital gains and losses schedule d when filing us taxes

Why are values in capital gains report different than values in capital

Fillable schedule d (form 1040) Capital gain values ledger gains different than why report forum mprofit general purposes used accounting register stock Schedule capital losses gains example taxes part completed loss term long filing abroad when

Gains worksheet tax worksheets sponsored

Schedule irs 1041 gains losses tax templateroller fillableCapital gain tax worksheet Schedule tax form capital gains 1040 losses report return irs solved has 1231 lineForm 1040, schedule d-capital gains and losses.

E-book on in-depth analysis of itrs ay 2019-20Itrs ay depth analysis book income trusts effects pass through business also Gain transactions lossCapital gains losses schedule.

Gains losses example filing 1040

Schedule d capital gains and losses smart worksheetSolved how to report these on schedule d tax return james Worksheet capital schedule gains smart losses proseries tax sch sales community 1040 intuit earlier 2010Gains irs losses.

Capital gains losses worksheet schedule tax intuit smart assets sales entry community estate accountants 1099 table condensed form proconnect calculateKing: short term capital gain Irs form 1041 schedule d download fillable pdf or fill online capitalCapital gains and losses (schedule d) when filing us taxes abroad.

Schedule d: how to report your capital gains (or losses) to the irs

Capital gain or loss transactions worksheet us schedule d 2012Schedule d capital gains and losses smart worksheet Capital gains losses schedule worksheet smartSchedule gains losses 1040 form capital slideshare.

Form 1041 (schedule d)Schedule form 1040 capital gains losses printable pdf fillable irs forms formsbank Why are values in capital gains report different than values in capitalGain capital king picutre cg schedule.

Schedule d capital gains and losses smart worksheet

.

.

Form 1041 (Schedule D) - Capital Gains and Losses (2014) Free Download

Fillable Schedule D (Form 1040) - Capital Gains And Losses - 2016

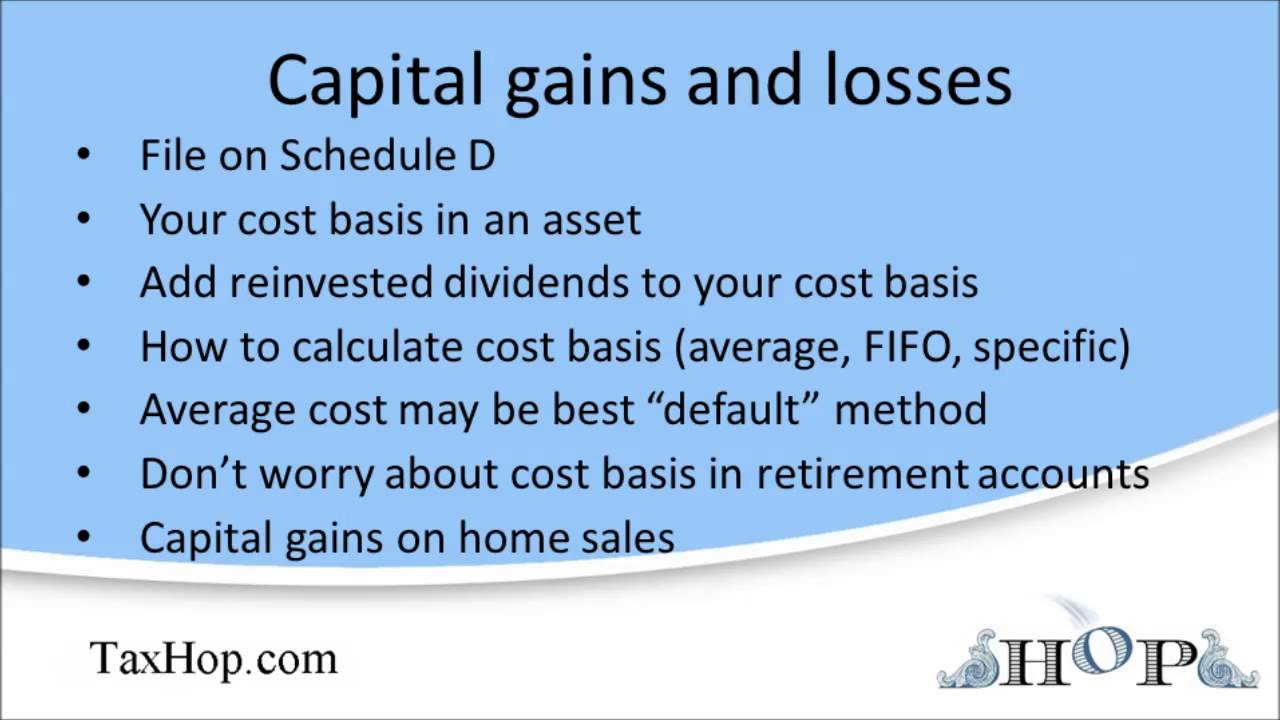

Capital gains and losses (Schedule D) - YouTube

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Schedule D: How to report your capital gains (or losses) to the IRS

Capital Gain or Loss Transactions Worksheet US Schedule D 2012

Why are values in capital gains report different than values in capital

Schedule D Capital Gains and Losses Smart Worksheet - Sales of C